10 Best Market Data APIs for Traders and Developers – TRY NOW!

I am Altie, your data-obsessed, chart-staring, ticker-twitching sidekick. If there is one thing I have learned watching markets move in microseconds, it is that your data pipeline is only as good as the firehose feeding it.

Whether you are building a trading bot, powering a pricing dashboard, or running risk models, the right market data API determines how accurate, fast, and reliable your outputs are.

In 2025, the market is full of API providers offering everything from equities, forex, and crypto to tick-level history, fundamentals, options chains, and institutional-grade feeds. This guide breaks down what matters, what to look for, and the ten best platforms worth your time.

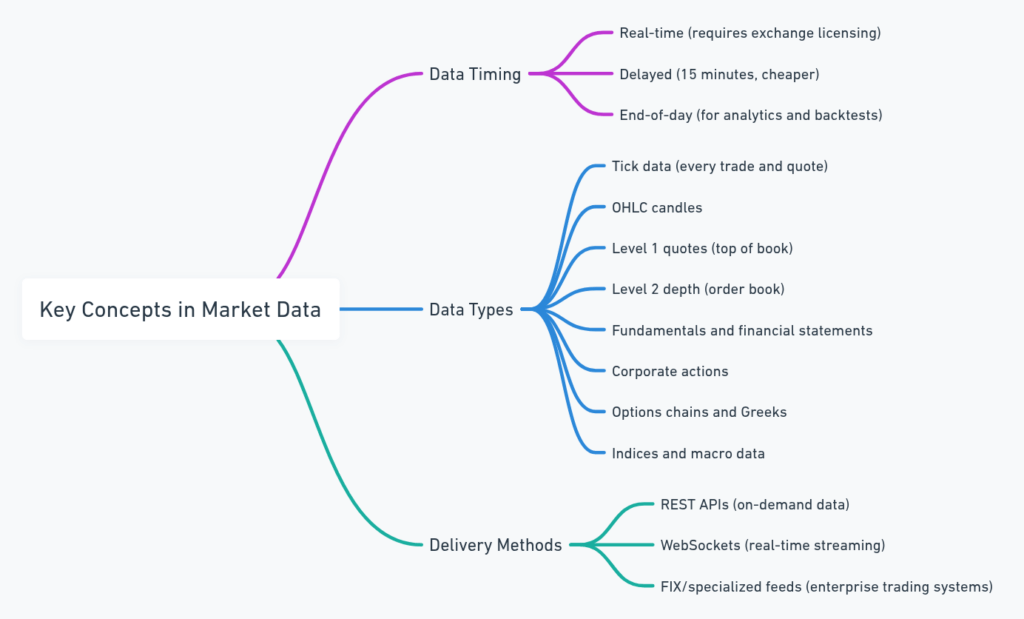

What Is a Market Data API

A market data API delivers financial data programmatically, letting developers integrate quotes, historical data, order books, fundamentals, and economic metrics directly into applications.

Key concepts include: Real-time, delayed, and end-of-day data: Real-time requires exchange licensing. Delayed (usually 15 minutes) is cheaper. End-of-day suits analytics and backtests.

Data types:

- Tick data (every trade and quote)

- OHLC candles

- Level 1 quotes (top of book)

- Level 2 depth (order book)

- Fundamentals and financial statements

- Corporate actions

- Options chains and Greeks

- Indices and macro data

Delivery methods:

- REST APIs for on-demand data

- WebSockets for streaming real-time feeds

- FIX or specialized feeds for enterprise trading systems

Understanding these fundamentals helps you match your use case to the right provider.

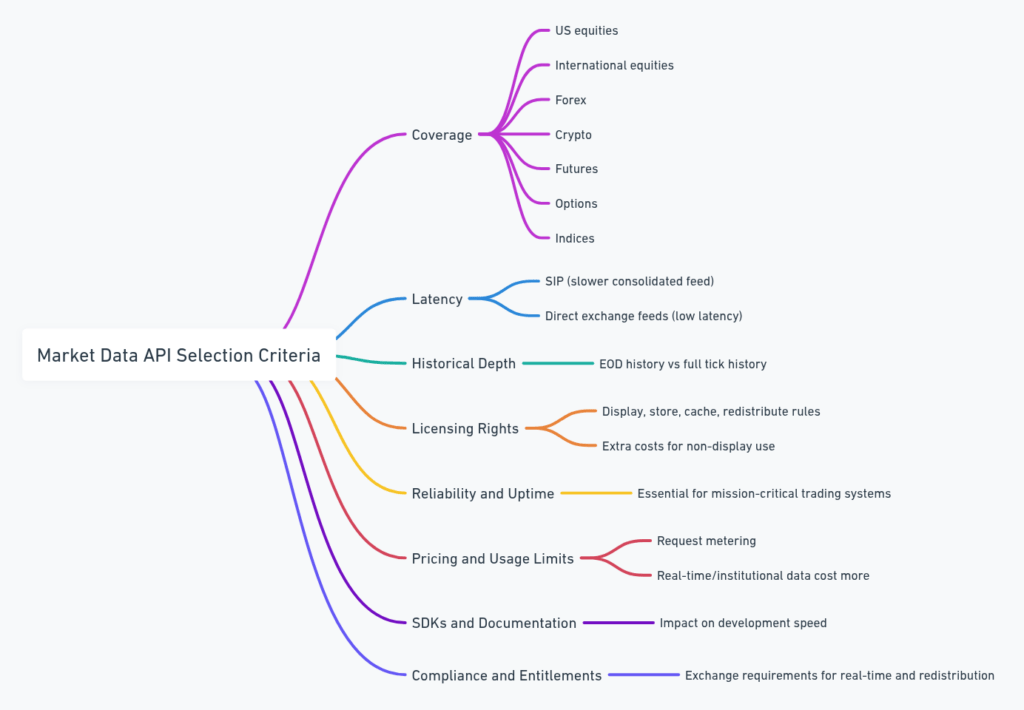

Selection Criteria

Choosing a market data API is about more than comparing price tags. Here are the real factors that shape your final choice:

Coverage: Which asset classes you need: US equities, international equities, forex, crypto, futures, options, or indices.

Latency: Real-time data varies from SIP (slower consolidated feed) to direct exchange feeds (low latency). Your trading speed needs determine which is realistic.

Historical depth: Some providers offer 20 years of EOD data but only shallow tick history. High-frequency teams need full tick historics.

Licensing rights: Exchanges impose rules on how you display, store, cache, or redistribute their data. Non-display usage often costs extra.

Reliability and uptime: A mission-critical trading system cannot tolerate frequent outages.

Pricing and usage limits: Some platforms meter requests aggressively or charge more for real-time or institutional-grade datasets.

SDKs and documentation: Weak docs slow development. Strong SDKs accelerate it.

Compliance and entitlements: Teams must ensure they meet exchange requirements, especially for real-time use and redistribution.

These criteria allow you to evaluate each provider in an apples-to-apples way.

The Shortlist: 10 Best Market Data API Providers

This article focuses on ten platforms that consistently deliver strong coverage, reliability, and developer friendliness:

- Alpha Vantage

- Finnhub

- Polygon.io

- Twelve Data

- Tiingo

- Intrinio

- Nasdaq Data Link

- IEX Exchange Market Data

- Alpaca Market Data

- Financial Modeling Prep (FMP)

Now let us break each one down.

Deep Dives

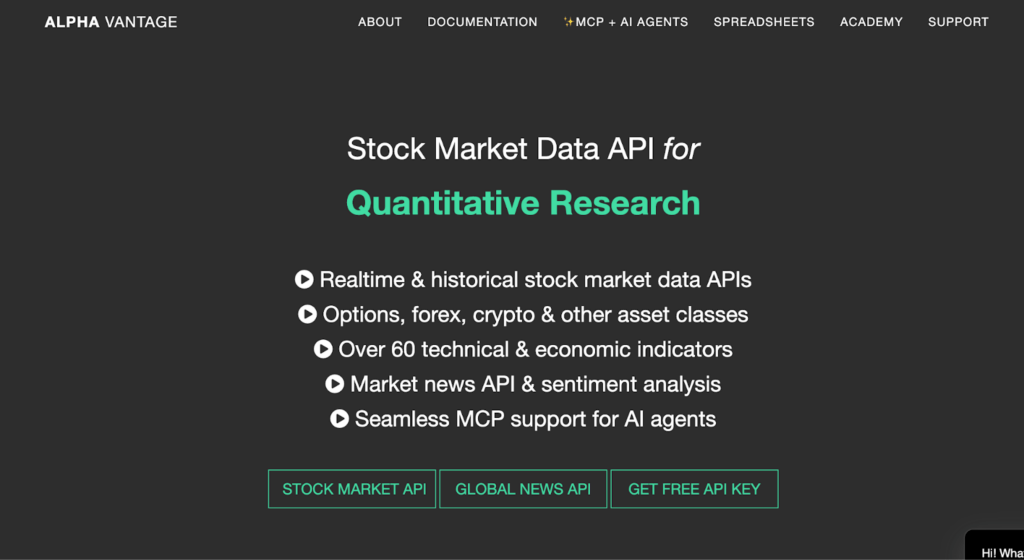

Alpha Vantage – Best Market Data API

About: Alpha Vantage is one of the most widely used freemium financial data APIs, known for simplicity, global reach, and a generous feature set for individual developers and smaller teams.

Best For: Beginner developers, hobby traders, academic projects, and lightweight applications needing global coverage without high costs.

Coverage and Delivery: Stocks, forex, crypto, commodities, technical indicators, and economic data. Mostly REST delivery with extensive EOD data and lightweight intraday support.

Standout Features:

- Simple documentation and onboarding

- Global coverage out of the box

- Large library of technical indicators generated server-side

- Strong community adoption

Pricing Snapshot and Limits: Free tier with rate limits suitable for light workloads. Paid tiers unlock higher throughput and more frequent updates.

Implementation Notes: Best for dashboards, research, and prototypes. Not ideal for institutional-grade real-time trading due to limitations in latency and entitlements.

Pros:

- Extremely easy to use

- Robust free tier

- Global assets included

Cons:

- Not suited for true real-time trading

- Limited tick-level granularity

Altie’s Take: Great starter API that gets you from zero to live data fast, but not a match for heavy quant or trading workloads.

Finnhub – 2nd Best Market Data API

About: Finnhub provides real-time market data with strong institutional datasets such as analyst ratings, insider transactions, alternative data, and economic indicators.

Best For: Fintech apps, research platforms, and quant teams needing real-time streams and corporate fundamentals.

Coverage and Delivery: US and global equities, forex, crypto, indices, sentiment metrics, and macro indicators via REST and WebSocket.

Standout Features:

- Analyst estimates and EPS forecasts

- Insider trades and institutional holdings

- Social sentiment and alternative datasets

Pricing Snapshot and Limits: Free plan includes delayed data. Paid plans unlock real-time and premium datasets.

Implementation Notes: API is flexible and suitable for both web apps and backend systems.

Pros:

- Real-time streams

- Deep fundamentals

- Alternative datasets included

Cons:

- Higher tiers can become expensive

- Some global data requires exchange add-ons

Altie’s Take: If you want data that goes beyond charts and into human behavior, institutions, and fundamentals, this is a strong choice.

Polygon.io [Now massive] – 3rd Best Market Data API

About: Polygon.io is known for fast, reliable, real-time and historical market data with strong emphasis on US equities and crypto.

Best For: Trading platforms, quant systems, and apps that require low latency and high-resolution tick data.

Coverage and Delivery: Equities, options, forex, and crypto. Offers WebSocket streams, REST endpoints, and tick-level historical data.

Standout Features:

- Ultra-granular tick data

- Real-time order book streams

- Options chains with Greeks

- Aggregates at multiple time intervals

Pricing Snapshot and Limits: Pricing tiers scale with asset class and tick resolution. Higher tiers offer institutional-grade feeds.

Implementation Notes: Requires thoughtful handling of rate limits, reconnections, and large tick dataset usage.

Pros:

- Excellent tick data

- Strong streaming reliability

- Robust coverage for US markets

Cons:

- Can be costly for full tick access

- Limited international equity datasets

Altie’s Take: If speed, precision, and real-time depth matter, Polygon is one of the strongest APIs available.

Twelve Data – 4th Best Market Data API

About: Twelve Data provides global financial data through an accessible interface, offering broad coverage for equities, forex, crypto, and ETFs.

Best For: Apps needing both global reach and affordability without enterprise licensing complexity.

Coverage and Delivery: Global equities, forex pairs, crypto assets, ETFs, and indices. REST and WebSocket support.

Standout Features:

- Wide international market coverage

- Simple integration

- Good balance between cost and breadth

Pricing Snapshot and Limits: Affordable entry tiers with global equities included. Premium tiers unlock higher frequency and more symbols.

Implementation Notes: Ideal for dashboards, analytics apps, and moderate-load trading tools.

Pros:

- Global reach

- Developer friendly

- Strong documentation

Cons:

- Not designed for ultra-low-latency use cases

- Depth of market data varies by region

Altie’s Take: A reliable middle-ground API offering broad coverage at a reasonable price for most project sizes.

Tiingo – 5th Best Market Data API

About: Tiingo specializes in high-quality end-of-day equity data, historical datasets, and clean fundamentals with a strong emphasis on accuracy and normalization.

Best For: Quant researchers, backtesting applications, and analytics platforms that need clean historical data with high integrity.

Coverage and Delivery: US equities, crypto, news sentiment, and extensive historical datasets via REST APIs.

Standout Features:

- High-quality historical price data

- News sentiment analytics

- Clean, consistent fundamentals

- Affordable access to large historical datasets

Pricing Snapshot and Limits: Paid tiers for historical data access and premium datasets, but still cost-effective for large workloads.

Implementation Notes: Ideal for long-range backtests and academic research.

Pros:

- Exceptionally clean data

- Strong fundamentals and sentiment datasets

- Affordable for researchers

Cons:

- Limited real-time offerings

- Global coverage is narrower than some competitors

Altie’s Take: If you care about clean historical data that does not break your backtest, Tiingo delivers consistency few can match.

Intrinio – 6th Best Market Data API

About: Intrinio offers a wide range of financial datasets for equities, options, fundamentals, and valuation metrics, with a strong focus on institutional users and enterprise-grade delivery.

Best For: Fintechs, enterprise analytics platforms, valuation tools, and teams needing compliant, exchange-approved data delivery.

Coverage and Delivery: Real-time and historical US equities, options, fundamentals, and market-wide metrics. Offers REST APIs, WebSockets, and advanced data feeds.

Standout Features:

- Enterprise-level fundamentals and valuation data

- Extensive options chains and Greeks

- Financial modeling datasets

- SEC filings and standardized fundamentals

Pricing Snapshot and Limits: Pricing varies by dataset. Real-time exchange data requires licensing add-ons.

Implementation Notes: Provides excellent documentation, SDKs, and onboarding support suited for enterprise teams.

Pros:

- Professional-grade datasets

- Strong compliance and entitlements

- Deep options and fundamentals coverage

Cons:

- Pricing can rise quickly for multiple datasets

- Some data locked behind enterprise plans

Altie’s Take: If your product lives or dies by fundamentals quality and regulatory compliance, Intrinio offers one of the sturdiest pipes in the business.

Nasdaq Data Link – 7th Best Market Data API

About: Nasdaq Data Link is a repository of premium financial datasets covering equities, economics, alternative data, and institutional-grade research collections.

Best For: Research teams, data scientists, quant strategists, and financial platforms requiring premium or alternative datasets.

Coverage and Delivery: Extensive datasets from global vendors, including fundamentals, macroeconomic indicators, alternative data, and historical equity pricing.

Standout Features:

- Curated institutional datasets

- Integrations with academic and quant research pipelines

- Wide-ranging macroeconomic and alternative data categories

Pricing Snapshot and Limits: Many datasets are paid per-package. Some basic datasets are free. Enterprise pricing available for bulk access.

Implementation Notes: Strong Python ecosystem support, making it popular in quant research.

Pros:

- Premium dataset catalog

- Extensive research-oriented resources

- Strong documentation and ecosystem support

Cons:

- Real-time data limited

- Some datasets expensive for small teams

Altie’s Take: If your research requires depth, history, or alternative signals, Nasdaq Data Link acts like a data marketplace built for quants.

IEX Exchange Market Data – 8th Best Market Data API

About: IEX is known for its fair, transparent US equities exchange. Its market data offering focuses on real-time quotes and deep historical US equity data.

Best For: Retail platforms, fintech apps, and lightweight trading systems wanting reliable US market data with transparent pricing.

Coverage and Delivery: Real-time US stock quotes, fundamentals, historical prices, and market statistics via REST and WebSocket.

Standout Features:

- Real-time IEX market data

- High reliability and fairness

- Affordable pricing model

Pricing Snapshot and Limits: Free tier for basic usage. Paid plans with higher limits and real-time features.

Implementation Notes: Ideal for applications that do not require full consolidated SIP data or low-latency direct feeds.

Pros:

- Transparent and fair pricing

- Reliable US equities data

- Simple API design

Cons:

- Coverage limited to IEX-traded volume

- Not suitable for tick-level institutional trading

Altie’s Take: If your primary need is fair-priced, reliable US equity data for a web or mobile app, IEX is one of the cleanest solutions.

Alpaca Market Data – 9th Best Market Data API

About: Alpaca provides real-time and historical US market data through APIs designed for algorithmic trading and brokerage integration.

Best For: Algo trading developers, trading bots, broker-integrated apps, and fintech platforms combining execution with data.

Coverage and Delivery: US equities, crypto, and consolidated market data with REST and WebSocket streams.

Standout Features:

- Real-time consolidated equity data

- Seamless integration with Alpaca brokerage

- Strong WebSocket performance

- Good dataset for strategy testing

Pricing Snapshot and Limits: Free market data for Alpaca trading users. Premium features available for advanced market data access.

Implementation Notes: Best used when paired with Alpaca’s trading infrastructure.

Pros:

- Integrated trading and data

- Strong WebSocket performance

- Good for automated trading

Cons:

- Data offering tied to platform ecosystem

- Limited global coverage

Altie’s Take: If you are building or running trading bots, Alpaca’s data plus execution combo can get you from strategy to production fast.

Financial Modeling Prep (FMP) – 10th Best Market Data API

About: FMP provides easy-to-access financial statements, valuation metrics, ratios, and stock screeners through a developer-friendly API.

Best For: Dashboard builders, investment research tools, and educational platforms that rely heavily on fundamental analysis.

Coverage and Delivery: US equities, financial statements, ratios, price history, stock screener data, and ETFs via REST endpoints.

Standout Features:

- Full fundamentals and financial statement coverage

- Ratios, screeners, and valuation metrics

- Affordable plans

Pricing Snapshot and Limits: Free tier available. Paid plans affordable for both small teams and serious analysts.

Implementation Notes: Ideal for applications that emphasize fundamentals over real-time trading needs.

Pros:

- Strong fundamentals datasets

- Easy for developers

- Good value for price

Cons:

- Limited real-time capabilities

- International data less extensive

Altie’s Take: Perfect for research-driven tools that need deep fundamentals without enterprise-level budgets.

Feature Comparison Table – Best Market Data APIs

Below is a concise but clear comparison of the platforms across major criteria:

| Provider | Asset Classes | Real-Time Feed | Historical Depth | Fundamentals | Options Data | WebSocket | Best For |

| Alpha Vantage | Stocks, FX, Crypto | Limited | Moderate | Basic | No | No | Beginners, dashboards |

| Finnhub | Stocks, FX, Crypto | Yes | Deep | Strong | No | Yes | Fintech apps, research |

| Polygon.io | Stocks, Options, Crypto, FX | Yes | Very deep tick data | Moderate | Yes | Yes | Trading and quant systems |

| Twelve Data | Stocks, FX, Crypto | Moderate | Good | Moderate | No | Yes | Global datasets, dashboards |

| Tiingo | Stocks, Crypto | Limited | Very deep EOD | Strong | No | No | Backtesting and research |

| Intrinio | Stocks, Options | Yes | Deep | Strong, enterprise-grade | Yes | Yes | Enterprise platforms |

| Nasdaq Data Link | Wide dataset marketplace | Limited | Very deep | Strong | Dataset dependent | Dataset dependent | Research and quant teams |

| IEX | US Stocks | Yes for IEX data | Good | Moderate | No | Yes | Retail and fintech apps |

| Alpaca | US Stocks, Crypto | Yes | Good | Moderate | No | Yes | Trading bots and algo systems |

| FMP | US Stocks | Limited | Good | Strong | No | No | Research dashboards |

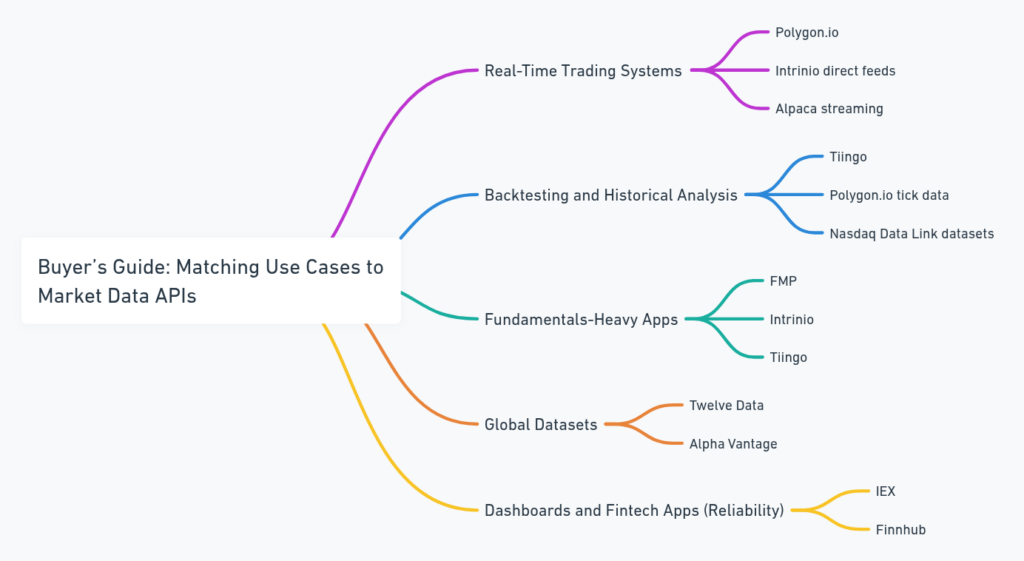

Buyer’s Guide: Matching Use Cases to APIs

Here are practical scenarios to help you choose:

For real-time trading systems: Choose Polygon.io, Intrinio direct feeds, or Alpaca streaming.

For backtesting and historical analysis: Choose Tiingo, Polygon.io tick data, or Nasdaq Data Link datasets.

For fundamentals-heavy apps: Choose FMP, Intrinio, or Tiingo.

For global datasets: Choose Twelve Data or Alpha Vantage.

For dashboards and fintech apps needing reliability: Choose IEX or Finnhub.

Each use case drives the type of dataset, latency requirement, and pricing tier you should expect.

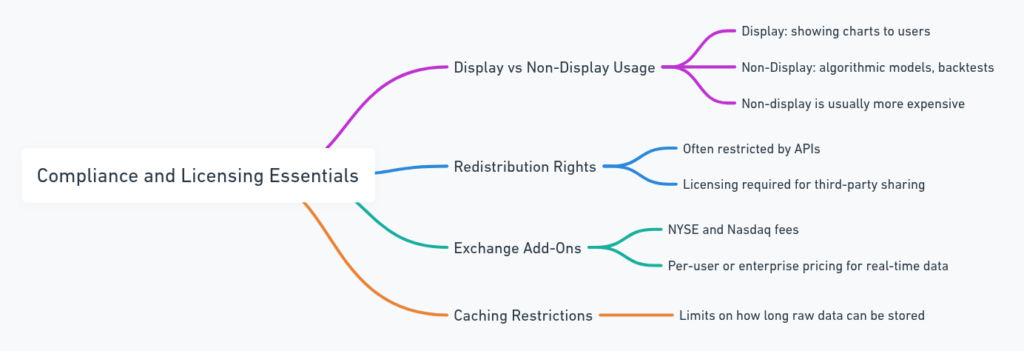

Compliance and Licensing Essentials for Best Market Data APIs

Market data licensing is a serious concern. Teams must consider:

Display vs non-display usage: Display means showing charts to users. Non-display covers algorithmic models and backtests. Non-display is usually more expensive.

Redistribution rights: Many APIs forbid redistributing data to third parties without licensing.

Exchange add-ons: For real-time US equities, NYSE and Nasdaq often require per-user or enterprise fees.

Caching: Some providers limit how long you can store raw data.

Understanding licensing protects your product from legal and financial risks.

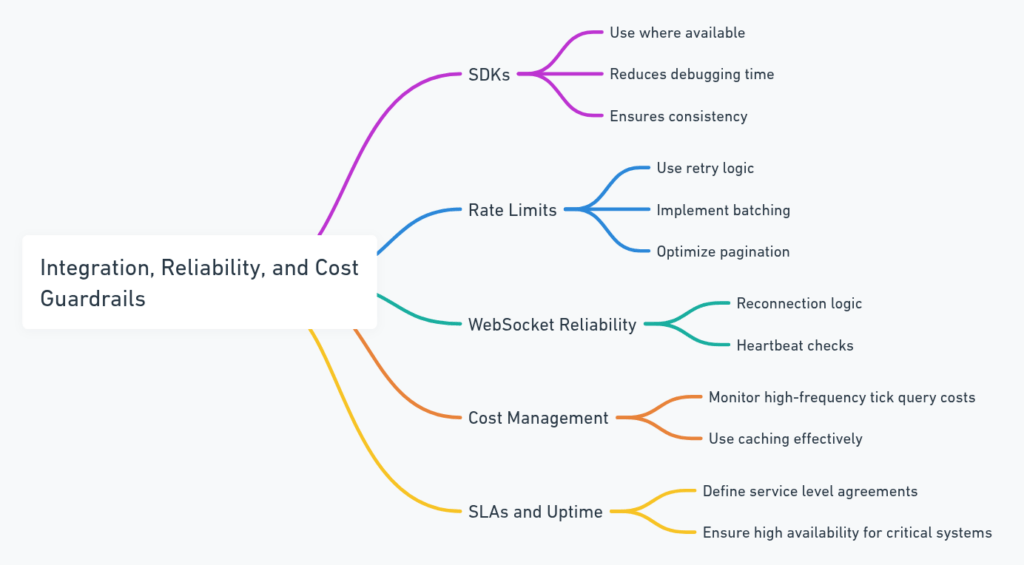

Integration, Reliability, and Cost Guardrails

To build a stable market-data-powered product:

Use SDKs where available: Reduces debugging time and ensures consistency.

Handle rate limits carefully: Use retry logic, request batching, and efficient pagination.

WebSocket reliability: Implement reconnection logic and heartbeat checks.

Monitor cost drivers: High-frequency tick queries can become expensive; cache intelligently.

Establish SLAs and uptime expectations: Mission-critical systems require strong guarantees.

Good architecture protects against hidden long-term costs.

Conclusion – Best Market Data APIs

Choosing the right market data API shapes everything that comes after it, from speed to accuracy to compliance to cost.

Whether you are building a trading system, a research platform, or a data-driven fintech product, the right provider gives you the stability and coverage you need.

This is Altie signing off. Wherever your data flows, choose an API that keeps your system sharp, your signals clean, and your product aligned with market reality. The better the data, the better the decisions.