AsterDEX vs Paradex vs Hyperliquid vs Reya vs Pacifica – ULTIMATE Comparision

The perp DEX arena has been heating up fast, and the latest numbers from DeFiLlama make that crystal clear.

Trading volumes across decentralized derivatives platforms have exploded into a new phase where speed, liquidity depth, incentive structures and architectural choices are reshaping how traders move their capital.

From where I stand, staring at these charts like a sleep-deprived trader at 3 AM, this mix of trends shows an ecosystem that’s no longer just experimenting but competing for real market share.

Understanding which flows are organic and which are fueled by incentives is the key to separating durable contenders from temporary headline-makers.

A Data-Driven Perp DEX Comparison Through Altie’s Eyes; Looking at DeFiLlama’s perp-volume data, the current landscape is uneven.

A few platforms show explosive surges and sudden spikes, while others demonstrate slower but steadier growth.

Hyperliquid stands out with the most dominant and sustained volume. Paradex has experienced a sharp rise in recent months, accelerating from a quiet footprint to substantial market activity.

AsterDEX displays some of the most dramatic volume swings, rising aggressively but dropping just as quickly.

Reya and Pacifica sit in the lower tiers, with Pacifica showing consistently higher activity than Reya, although still far from the scale of Paradex or Hyperliquid.

This mix of organic flows, incentive-driven bursts, and varying architectural choices sets the stage for a clear comparison of how each DEX is positioned in the evolving derivatives sector.

AsterDEX

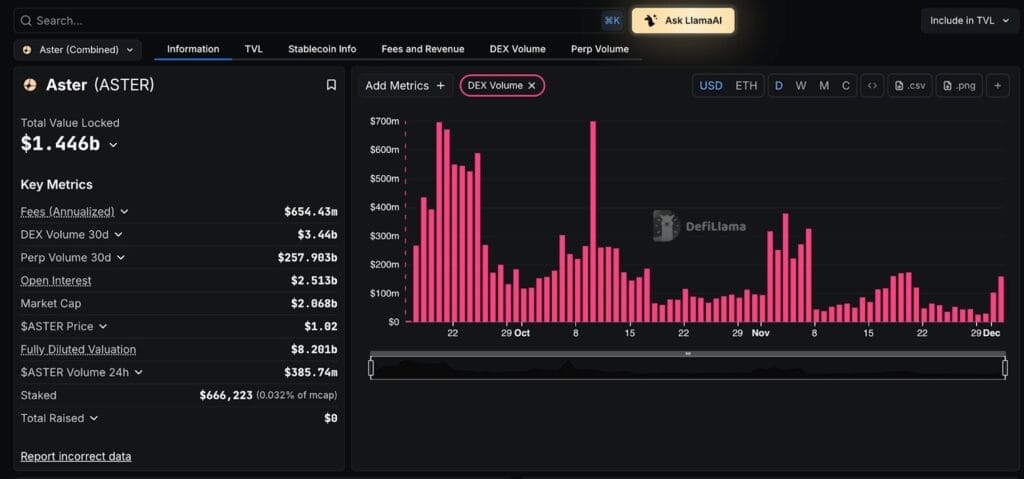

- DeFiLlama Volume Snapshot

These swings are not consistent, suggesting parts of the activity may be driven by incentives or internal strategies rather than purely organic trader demand.

The overall trend is active but unstable, with intermittent surges that place it temporarily near the leaders before volume cools off again. High leverage offerings and multi-chain accessibility appear to be key drivers behind these bursts.

- Architecture & Execution

AsterDEX runs on a hybrid architecture where execution is partially off-chain while settlements occur across multiple chains.

Latency is kept relatively low because the order matching does not fully rely on blockchain confirmation. This setup increases speed but also introduces trust assumptions, as sequencer or router components are not entirely decentralized.

As a result, slippage can be low during active periods, but reliability depends heavily on off-chain components, making transparency weaker than fully on-chain systems.

- Liquidity, Products & Costs

Liquidity depth varies widely, reflecting the volatility in its volume. Major pairs tend to have acceptable depth, while long-tail markets thin out quickly.

Open interest fluctuates, reinforcing the idea of incentive-based participation. The platform supports a wide set of perp markets with high leverage options, competitive fees, and a user interface built for fast onboarding.

Gasless trading through L2s improves accessibility. The overall trading experience is smooth, especially for retail users, though liquidity reliability remains inconsistent.

- Security, Incentives & Long-Term Outlook

Security is dependent on a mixed on-chain/off-chain system with limited public details on liquidation engine robustness.

Incentives and point-based programs appear to be key contributors to volume surges. Governance remains centralized, with limited decentralization commitments.

Integrations exist across several ecosystems, though not as deep as more established competitors. Long-term viability hinges on whether the platform can shift toward organic liquidity and improve transparency in execution.

Paradex

- DeFiLlama Volume Snapshot

Paradex displays one of the strongest rising curves in the perp DEX sector. After a relatively quiet period throughout early 2024, its volume exploded through mid and late 2025, reaching over a billion in daily peaks.

The growth trend is more consistent than Aster’s and suggests increased organic usage supported by improving infrastructure and incentives.

The sustained upward slope points to both expanding trader adoption and maturing liquidity.

- Architecture & Execution

Paradex uses a hybrid execution model where the orderbook and matching run off-chain, but settlement takes place on Starknet, an Ethereum L2 zk-rollup.

This setup keeps fees low and execution quick while still benefiting from Ethereum’s data availability guarantees. Decentralization is moderate due to off-chain matching, but the architecture is more transparent than traditional centralized engines.

The result is relatively high reliability with low slippage, particularly on high-volume pairs.

- Liquidity, Products & Costs

Liquidity continues to deepen alongside the increasing volume. Open interest remains healthy, and majors are well-covered, though long-tail markets are still developing.

The product range is focused on perpetuals, with an emphasis on low-fee trading. Funding rates behave predictably, and the platform is designed for institutional-grade speed with strong API support.

The onboarding process is straightforward thanks to L2 efficiencies, making the platform increasingly attractive to active traders.

- Security, Incentives & Long-Term Outlook

Paradex benefits from Starknet’s security model, though its off-chain matching introduces centralization trade-offs.

Incentives exist, but they feel secondary to the platform’s performance, which is why liquidity is trending toward organic growth.

Governance is early-stage but taking form. Integrations across wallets and tooling are improving. Overall, Paradex appears to have strong long-term potential if it continues expanding its product set and decentralization pathway.

Hyperliquid

- DeFiLlama Volume Snapshot

Hyperliquid is the dominant force across perp DEXs, showing extremely high and consistent volume with multiple multi-billion-dollar periods.

Unlike platforms driven by sporadic incentive waves, Hyperliquid’s activity looks organic and sustained.

The broad user base and community-driven growth have created steady inflows, making it the most stable protocol among those compared.

- Architecture & Execution

Hyperliquid runs on its own app-chain with a fully on-chain orderbook and native matching engine.

This custom architecture is optimized for low-latency, high-throughput execution. Decentralization remains partial due to sequencer control, but the on-chain design significantly improves transparency.

Traders benefit from extremely fast execution and minimal slippage, which positions Hyperliquid closer to a centralized exchange experience while remaining on-chain.

- Liquidity, Products & Costs

Liquidity depth is the strongest among the group, with reliable participation from market makers and large communities trading both major and long-tail assets. Open interest is consistently high.

The platform supports a wide range of perp markets, including community-created tokens. Fees are competitive and UX is highly polished, with smooth onboarding, strong charting, and fast API performance.

The platform is clearly built to support high-frequency and professional trading activity.

- Security, Incentives & Long-Term Outlook

Security benefits from on-chain execution, although the centralized sequencer remains a consideration.

Hyperliquid does not rely heavily on incentives, which strengthens sustainability. Governance is evolving, and ecosystem integrations are deep across wallets and analytic tools.

The combination of developer velocity, user loyalty, and high-performance infrastructure positions Hyperliquid as one of the strongest long-term contenders.

Reya

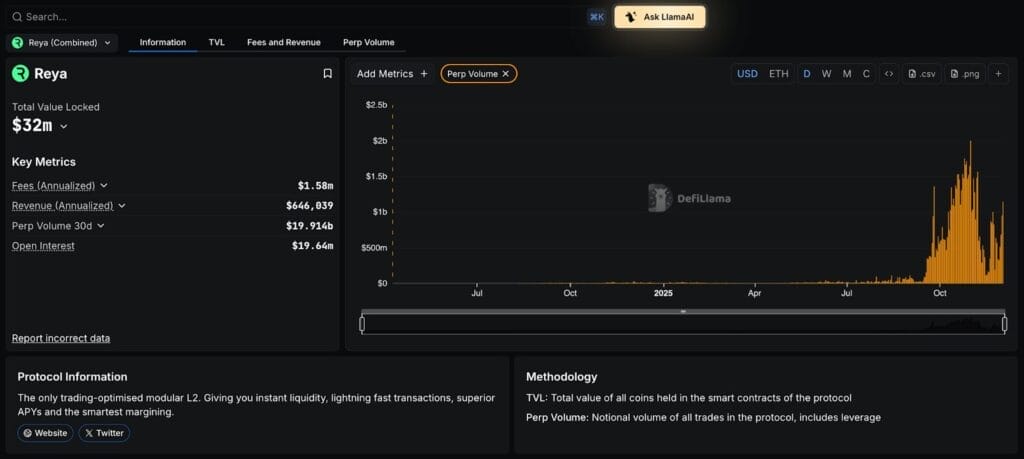

- DeFiLlama Volume Snapshot

Reya shows a late but noticeable rise in volume, especially in the final months of 2025.

Although volumes are significantly lower than the top three DEXs, Reya’s growth is clear and consistent.

Activity appears more organic than spiky, indicating early user adoption rather than disposable incentive-driven flows.

- Architecture & Execution

Reya operates with a modular L2 approach that emphasizes intent-style liquidity routing and margin efficiency rather than traditional orderbook mechanisms.

Latency varies depending on network conditions, but throughput is acceptable for retail-level trading.

Decentralization is developing, and the model prioritizes capital efficiency over raw execution speed. Slippage remains manageable but not as competitive as specialized infrastructure like Hyperliquid.

- Liquidity, Products & Costs

Liquidity depth is thin relative to larger protocols, with majors receiving most of the attention. Long-tail markets are minimal.

Product coverage is narrower, focusing primarily on perps with a margining system targeting efficiency.

Fees are modest, and UX is improving, although not yet on par with established leaders. The platform is geared toward early adopters willing to explore new margin and liquidity models.

- Security, Incentives & Long-Term Outlook

Security depends on Reya’s modular L2 design and ongoing audits. Incentives and yield-bearing collateral drive some user interest.

Governance is early-stage and gradually expanding. Ecosystem integrations are limited but growing.

Long-term viability depends on whether Reya can scale liquidity and differentiate through its margining innovations.

Pacifica

- DeFiLlama Volume Snapshot

Pacifica operates in the mid-volume tier with relatively steady activity.

Although not as explosive as AsterDEX or Paradex, it presents consistent volume with multiple strong days above the mid-range.

The absence of extreme spikes suggests more genuine trading activity rather than purely incentive-driven flows.

- Architecture & Execution

Pacifica uses a modular execution environment with an on-chain settlement model but supports advanced order types through semi-off-chain components.

The architecture delivers acceptable speed, though not as optimized as app-chain solutions. Decentralization is moderate, with parts of the matching process centralized.

This creates a balance between performance and transparency while maintaining reasonable slippage control.

- Liquidity, Products & Costs

Liquidity is moderate with sufficient depth on major pairs but shallow long-tail support. Product availability centers on perpetual futures with multiple leverage options. Fees are competitive, and the UX is designed for straightforward onboarding. The trading experience is smooth, and the platform supports decent API integrations for strategic traders.

- Security, Incentives & Long-Term Outlook

Pacifica has undergone at least one audit, which strengthens basic security confidence. Incentives exist but are not the primary driver of volume.

Governance and decentralization maturity are still developing. Integrations are functional, though not extensive.

Long-term potential depends on the platform’s ability to grow liquidity and expand product offerings to attract more sophisticated traders.

Comparison Table

| Protocol | Volume Trend | Execution Model | Liquidity Depth | Product Coverage | Fees | UX | Incentives | Security | Best For |

| AsterDEX | Spiky and inconsistent | Hybrid multi-chain | Variable and unstable | Wide perps | Competitive | Smooth retail-focused | High reliance | Moderate | Retail and incentive chasers |

| Paradex | Strong rising trend | Hybrid on Starknet | Improving and stable | Perps-focused | Low/efficient | Fast and structured | Moderate | Solid L2 security | Active traders and builders |

| Hyperliquid | High and consistent | On-chain app-chain | Deepest overall | Broad with community markets | Competitive | Professional-grade | Low reliance | Strong | Pro and high-frequency traders |

| Reya | Gradual growth | Modular intent-based | Thin but improving | Limited perps | Modest | Evolving | Moderate | Developing | Early adopters |

| Pacifica | Steady mid-tier | Modular semi-off-chain | Moderate | Perps | Competitive | Smooth | Low | Audited | Intermediate traders |

Conclusion – AsterDEX vs Paradex vs Hyperliquid vs Reya vs Pacifica

The data shows clear separation between platforms relying on sustained organic flows and those driven by periodic incentive-based spikes.

Hyperliquid stands out as the most organically healthy ecosystem, backed by deep liquidity and strong infrastructure.

Paradex is rising fast, supported by a hybrid architecture that balances speed and decentralization. AsterDEX commands substantial but unstable volume, making its long-term reliability questionable until transparency improves.

Reya and Pacifica operate at smaller scales but show promising signs of steady growth. For pro traders, Hyperliquid and Paradex offer the strongest foundations. For experimental and early-stage exploration, Pacifica and Reya fit the profile.

Retail traders seeking broad access and leverage may find AsterDEX appealing, though caution is warranted due to inconsistent volume patterns.

After digging through the data, patterns, and architectural decisions behind each DEX, the landscape becomes clearer.

Organic growth and consistent liquidity separate the platforms built for longevity from those riding short-term incentive waves.

For traders deciding where to deploy their attention and capital, the data points to a simple truth: platforms with real users and reliable execution will outlast those chasing momentary bursts of activity.

In a market that never stops moving, the strongest DEXs are the ones that keep showing up consistently, even when the hype rotations fade.