Melee Review: Predict Anything

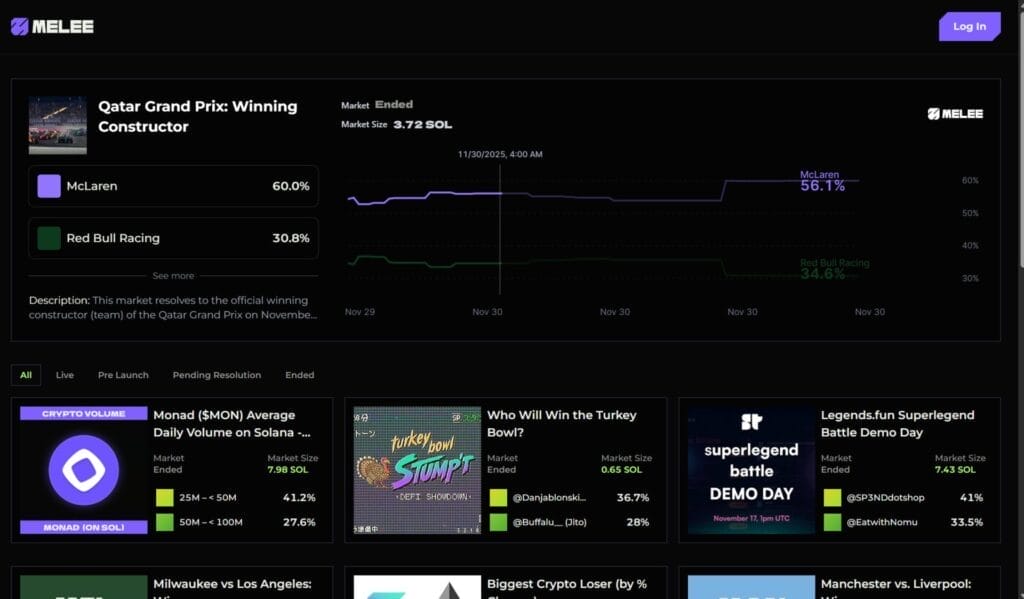

Prediction markets are experiencing a renaissance, and Melee is emerging as one of the most innovative players in the space. Described as “Pumpfun meets Polymarket,” Melee reimagines what a prediction market can be by combining permissionless market creation, bonding-curve pricing, and creator monetization into a single viral platform. At its core, Melee lets users predict anything, profit from being early, and capitalize on shifting probabilities. Rather than relying on gatekeepers or fixed-odds markets, Melee turns each prediction into a dynamic on-chain asset whose value grows as the market grows. Read this Melee Review to know more about the platform.

What is Melee?

Melee is a viral, permissionless prediction market platform that blends the mechanics of Pump.fun with the user-driven market creation of Polymarket. It allows anyone to speculate on any question—factual or opinion-based—using a bonding-curve pricing system that rewards people who are early and accurate.

Unlike traditional prediction markets where profit is tied only to choosing the correct outcome, Melee lets early buyers profit from market growth itself. This structure gives early speculators the potential for outsized returns (100x+), while also ensuring all positions are final—removing rug-risk or liquidity issues.

Melee also aims to be creator-first: influencers will be able to launch their own markets, engage their audience, and earn revenue based on the volume their markets generate.

Also, you may read LAB Review: The Ultimate Multi-Chain Trading Infrastructure

Melee Review:How does Melee Work?

Market Structure

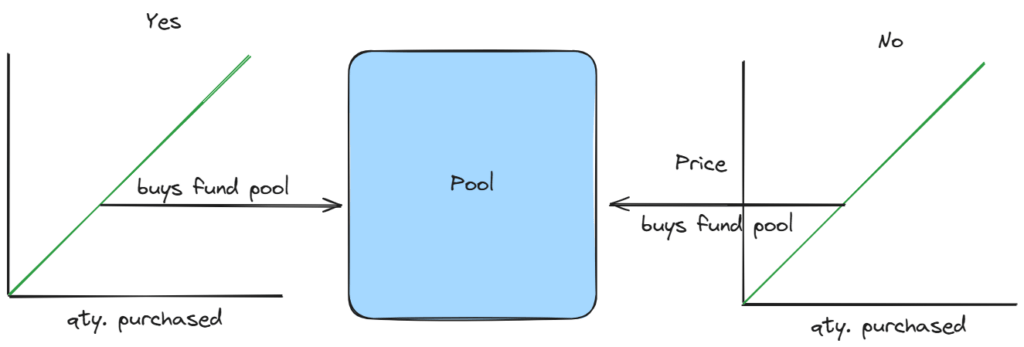

Melee uses a bonding-curve market structure where each outcome in a prediction market has its own price curve. Instead of fixed odds or $1-capped shares, users buy directly from these curves, meaning early participants get lower prices and higher potential returns.

When the market resolves, winners get their initial stake back plus a proportional share of the losing pools, creating always-on liquidity, uncapped upside, and strong incentives to grow the markets they believe in.

- Each market supports 2–32 outcomes, each with its own bonding curve.

- Earlier buyers pay less, giving them a stronger cost basis and higher % returns.

- All liquidity is locked (paramutual), so positions are final—no market makers needed.

- On resolution, winners receive their initial stake back + a share of losing pools.

- No $1 cap → unlimited upside, similar to viral bonding-curve tokens.

- Users benefit from driving more participants into markets they hold.

- Simple structure: buy outcome → market grows → your position becomes more valuable.

Also, you may read Top 10 APIs To Get Real Time Data Raydium Trading Bots

Market Outcomes

When a Melee market resolves, users who picked the correct outcome first get their initial investment back. Then all the money invested in the losing outcomes is distributed to the winners pro rata, based on how many shares they own. Because shares get more expensive along the bonding curve, early buyers get more shares per SOL and therefore earn a larger share of the final payout.

- Winners always receive their initial stake back.

- All funds from the losing pools are distributed to the winners.

- Payouts are proportional to share ownership.

- Early buyers earn more because they buy shares at lower cost and accumulate more of them.

- Total payout = initial investment + (losing pools × share ratio).

Example Payout Table

| User | Initial Investment | Shares Owned | Share % of Winner Pool | Payout Formula | Total Payout |

|---|---|---|---|---|---|

| User 1 | 1 SOL | 10,000 | 50% | 1 SOL + 8 SOL × 0.50 | 5 SOL |

| User 2 | 1 SOL | 5,000 | 25% | 1 SOL + 8 SOL × 0.25 | 3 SOL |

| User 3 | 2 SOL | 5,000 | 25% | 2 SOL + 8 SOL × 0.25 | 4 SOL |

Total winning shares = 10,000 + 5,000 + 5,000 = 20,000 shares

Losing pools = 8 SOL

Also, you may read 10 Best Solana Arbitrage Bots

How to Buy

Melee gives users two ways to enter a market: picking specific outcomes through Positional Buys, or buying every outcome via Melee All. Positional Buys reward being right and early, while Melee All rewards being early to market growth even if you don’t know which outcome will win. The fewer outcomes you buy, the higher the potential return—but the more conviction required.

| Feature | Positional Buy (Single Outcome) | Melee All (All Outcomes) |

|---|---|---|

| What You Buy | One outcome | Every outcome |

| Core Bet | Being right | Market growth |

| Risk Level | High (position goes to zero if wrong) | Lower (wins can offset losses) |

| Upside Potential | Highest if right & early | Strong upside from early entry |

| When It Pays | When your chosen outcome wins | When the market grows significantly |

| Share Price Advantage | Early = cheaper shares | Early = cheaper shares on all outcomes |

| Best For | High-conviction traders | Users bullish on market size, not direction |

| Example | Bet “Yes” on Pacers; win or lose all | Buy both outcomes early; if both 2×, you profit even if one loses |

Melee Review:Opinions Market (Coming Soon)

Opinion Markets are an upcoming Melee feature that blend the virality of meme coins with the structure of prediction markets. Instead of resolving based on external events, they settle algorithmically using the opinions of participants themselves. Users buy outcomes, privately predict how others will vote, and earn rewards for being early, correct, and accurate about crowd sentiment.

- Resolve algorithmically based on participant opinions—no external oracle.

- 2–32 outcomes, each with its own bonding curve.

- Private positions prevent bandwagoning and encourage honest votes.

- Users also submit a Second-Order Question (SOQ): predict what % of others agree.

- Winners receive stake back + share of losing pools, scaled by accuracy.

- Rewards combine early entry, correct outcome, and SOQ precision.

- Ideal for viral, cultural, or controversial questions (e.g., “100 men vs. 1 gorilla”).

Also, you may read Ethereum Price Prediction for 2025

How Opinion Markets Work

| Stage | What Happens | Why It Matters |

|---|---|---|

| Market Creation | Creator launches a topic with 2–32 outcomes, each with a bonding curve. | Enables permissionless, viral debates. |

| Speculation | Users buy shares; early buyers get cheaper shares. Positions stay private. | Rewards early conviction, prevents bandwagoning. |

| SOQ Submission | Users predict what % of the market will agree with their chosen outcome. | Measures accuracy about crowd sentiment. |

| Resolution | Actual opinion distribution is revealed. Majority outcome wins. | Clear, algorithmic resolution—no oracle. |

| Payout Scaling | Payouts increase with SOQ accuracy → adjusted shares → proportional pool distribution. | Rewards being early, correct, and precise. |

Also, you may read Hyperliquid vs Rollx vs AsterDEX vs Avantis vs Paradex

Melee Review: Creators

Creators are central to Melee’s growth. The platform allows them to turn cultural influence and audience engagement into revenue by launching markets—without needing approvals or risking their reputation. With both fact-based and opinion-based markets, creators can monetize attention in a way aligned with how culture actually spreads: fast, viral, and community-driven.

| Feature | Description | Why It Matters |

|---|---|---|

| Permissionless Creation | Launch markets instantly with no gatekeepers. | Maximizes creative freedom and speed. |

| Fact or Opinion Markets | Support both real events and pure opinion battles. | Enables broad, cultural participation. |

| Built-In Monetization | Earn a percentage of trading volume. | Sustainable revenue without ads or tokens. |

| Reputation Safe | Creators don’t take sides—just host the arena. | No backlash or bias concerns. |

| Viral Mechanics | Bonding curves reward early sharing. | More volume → more earnings for creators. |

Also, you may read Hyperliquid vs Pacifica vs Reya vs EdgeX vs Orderly

Benefits

- Direct Monetization: Turn engagement into revenue—no ads or sponsors needed.

- Viral Growth Loops: Bonding curves incentivize early sharing and participation.

- Creative Freedom: Launch markets on anything your audience cares about.

- Reputation-Safe: Creators host the market—they don’t have to pick sides.

Melee Review: Trading Guide

Hedging

Traditional prediction markets update odds instantly through market makers—even without real trades—leaving little room for speculators to profit from reacting faster than the system. Melee flips this dynamic: odds move only when traders actually put money in, creating opportunities for early movers and enabling cross-platform hedging when Melee’s volume-driven prices temporarily diverge from orderbook-driven odds elsewhere.

- Melee odds = volume only → prices change only when users trade.

- Traditional odds = market makers → prices can swing instantly with no trades.

- Speculators on Melee can move odds themselves by being early.

- Cross-platform arbitrage becomes possible when Melee’s odds lag behind other markets.

- Early conviction is rewarded, not just passive market efficiency.

Why It Matters

- Melee gives traders a speculative edge during fast-moving events.

- Diverging odds allow hedging and arbitrage across platforms.

- Traders can capture upside normally reserved for market makers.

Also, you may read Earn Passive Income Using Crypto Arbitrage In India

CTOing (Overview)

In crypto communities, token holders naturally act as evangelists—building tools, spreading memes, and attracting new participants to boost the value of what they hold. Melee mirrors this dynamic. By entering a market early, users are incentivized to promote it, create content, and bring in more participants, because growing the market directly increases the value of their own positions.

- Early buyers benefit most, just like early token holders.

- Users are incentivized to promote the markets they’re in.

- Sharing, memeing, and onboarding others increases market size → increases returns.

- Growth becomes community-driven, not platform-driven.

- Profitability scales with participation, virality, and engagement.

Also, you may read 10 Best Contract Management Software

Melee Review: Community

Join the Melee community on Telegram and Twitter to get real-time market updates, exclusive insights, and direct access to fellow traders and the team. Stay ahead of the biggest opportunities, catch important announcements as they drop, and connect with a fast-growing network of speculators shaping the future of viral markets.

Conclusion

Melee reimagines prediction markets for the modern internet—permissionless, viral, and built around early participation. With bonding-curve mechanics, creator-driven markets, opinion-based resolutions, and community-powered growth loops, Melee turns culture, conviction, and speculation into a unified experience. Whether you’re a trader, creator, or curious spectator, Melee offers a new way to engage with the moments that shape the world in real time. Welcome to the future of markets—welcome to Melee.

Frequently Asked Questions

Is this the final version of Melee?

No. This is the Alpha — the first public release of a completely new financial primitive. Melee is experimenting with a fresh prediction-market design built on bonding curves, and this is your chance to experience it early. Kick the tires, share feedback, influence how it evolves, and—if you’re early and right—capture meaningful upside along the way.

What are odds?

Odds on Melee come from how much total money is backing each outcome. If more people buy one side, its price goes up. The odds only move when real money moves, not when a market maker updates them.

How do markets end?

Markets close when their time expires, and they’re resolved based on the objective result of the event. Once resolved, winnings are distributed to be claimed by users.

- What Is N1

- N1 Ecosystem and Decentralization

- Free vs. Paid: TradingView Pine Scripts vs. LuxAlgo vs. Indicator Vault — Do Premium Indicators Actually Beat Free Ones?

- LuxAlgo vs. Bookmap vs. GoCharting — Indicators vs. Order Flow: Which Trading Edge Is Real?

- LuxAlgo vs. Tickeron vs. Trade Ideas vs. TrendSpider vs. Pineify — Best AI Trading Tool for Retail Traders in 2026