Bullet Review: Is Bullet Worth Using

When traders start looking beyond basic DEX swaps and into serious, performance-driven crypto trading, platforms like Bullet begin to stand out. Built for speed, precision, and professional-style execution, Bullet aims to bridge the gap between centralized exchanges and decentralized finance, offering a more advanced environment for active traders who care about latency, liquidity, and control. Read this Bullet Review to know more about the platform.

What is Bullet?

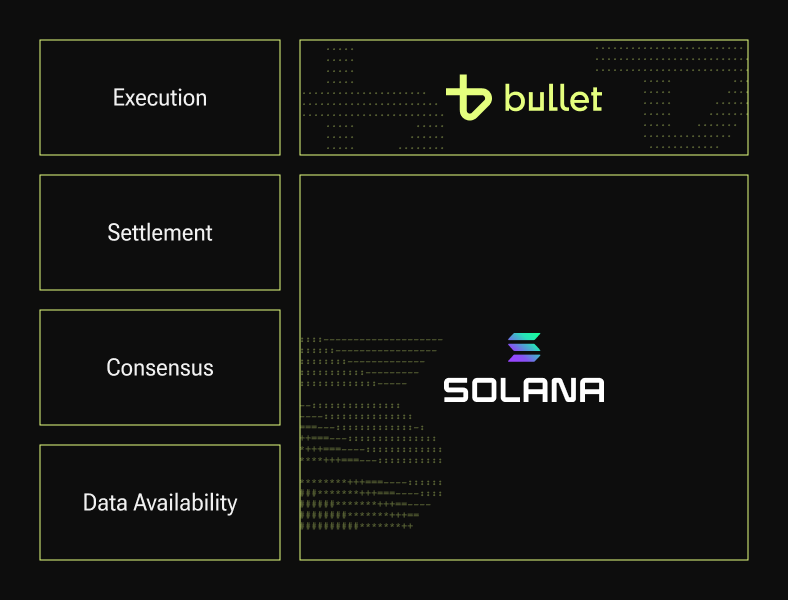

Bullet is a high-performance decentralized trading platform built on Solana that focuses on delivering fast, reliable, and non-custodial trading experiences. It provides an exchange-style interface with advanced order execution, real-time markets, and deep liquidity, designed especially for active and professional traders. By leveraging Solana’s high throughput and its own optimized trading infrastructure, Bullet enables users to trade digital assets with CEX-like speed while retaining full ownership of their funds. In simple terms, Bullet combines the efficiency of centralized exchanges with the transparency and security of DeFi.

Also, you may read Hyperliquid vs Pacifica vs Reya vs EdgeX vs Orderly

Bullet Review: Key Features

Core Trading & Performance Features

- Dedicated execution layer with owned blockspace for high reliability

- Several thousand TPS without competing with NFTs, games, or memecoins

- Sub-2 millisecond soft finality for near-instant trade confirmation

- Optimized infrastructure for real-time price discovery

- CEX-like latency for professional and high-frequency traders

Also, you may read Top 10 PolyMarket Analytics Tools

Network & Infrastructure Advantages

- Network extension model built on Solana for settlement and data availability

- Modular sequencing system for efficient transaction ordering

- Application-specific blockspace to avoid network congestion

- Independent from Solana’s general congestion cycles

- Designed for stable uptime during high-volatility periods

Also, you may read Paradex Review: Next-Generation Decentralized Derivatives Exchange

Market Structure & Liquidity Protection

- MEV-aware sequencing rules to protect market makers

- Priority for maker order flow over toxic arbitrage

- Reduced quote sniping and latency arbitrage

- Fairer environment for small and mid-sized liquidity providers

- Encourages tighter spreads and deeper liquidity

Also, you may read Hyperliquid vs Orderly vs Avantis vs Reya vs Based

User Experience & Accessibility

- Embedded wallets with no browser extensions required

- No need to manage seed phrases manually

- Gasless trading via integrated paymaster

- Fast, trust-minimized bridging from Solana L1

- Built-in fiat onramps for easy onboarding

Also, you may read 8 Platforms to Discover New Coin Listings for Trading

Developer & Institutional Connectivity

- REST and WebSocket APIs similar to CEX platforms

- Native client support for Rust and Python

- Future support planned for FIX protocol

- Easier integration for trading firms and bots

- Standardized tooling for institutional adoption

Also, you may read HyperLiquid vs Lighter vs AsterDex vs Hibachi

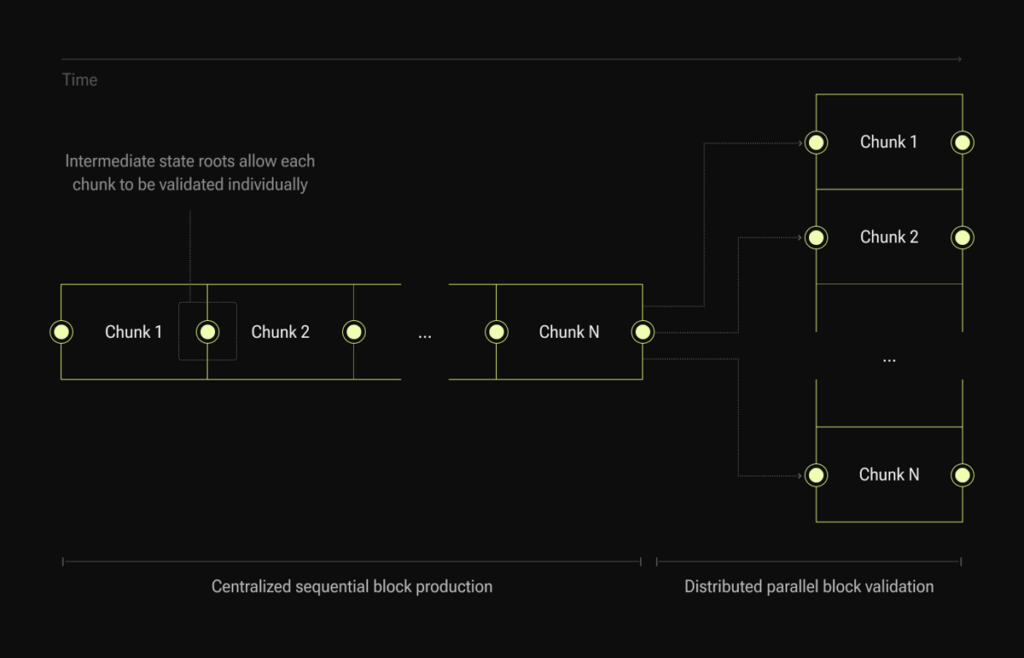

Security, Transparency & Verification

- Zero-knowledge virtual machine (zkVM) execution

- Cryptographic proofs for every transaction

- On-chain data availability on Solana

- Trustless public verification of all activity

- “Don’t trust, verify” security model

Economic & Cost Efficiency

- No wasted gas on unfilled limit orders

- Predictable execution environment

- Lower operational costs for market makers

- Reduced priority fee bidding wars

- Sustainable long-term cost structure

Also, you may read Top 10 Best Trading Podcast

Architecture & Long-Term Vision

- Built entirely in Rust for performance and safety

- Inspired by Ethereum Endgame architecture

- Centralized sequencing with decentralized verification

- Censorship-resistant execution model

- Designed for institutional-grade DeFi trading

“Silver Bullet” Philosophy

- Combines Solana speed with Ethereum-style security

- No trade-off between decentralization and performance

- Supports high-frequency trading without centralization risk

- Fully verifiable yet ultra-fast execution

- Blueprint for next-generation on-chain exchanges

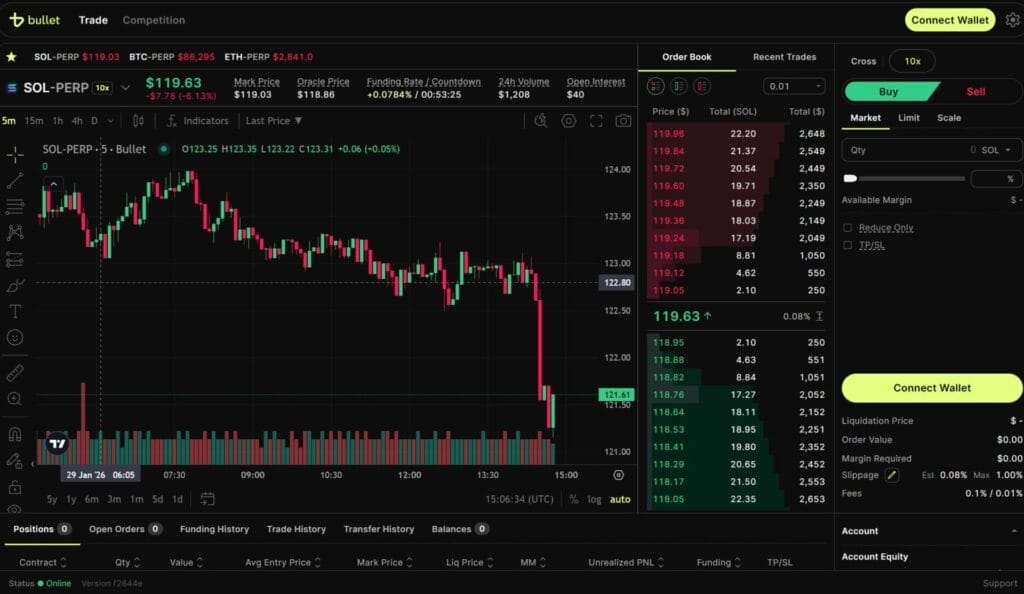

Bullet Review: BulletX (Exchange)

Products and Markets on Bullet

Bullet brings together derivatives, spot trading, lending, and automated strategies under one unified trading platform. Instead of switching between multiple DeFi apps, users can manage active trading, long-term investing, and yield generation within a single ecosystem. This integrated approach is designed to improve capital efficiency, reduce friction, and create a seamless experience for both professional traders and long-term investors.

Perpetual Futures (Perps)

Bullet’s perpetual futures market is built for active traders who want to go long or short with flexible margin options and high capital efficiency. Perpetual contracts allow traders to speculate on crypto prices without owning the underlying asset and without worrying about expiry dates. This makes them one of the most widely used instruments in modern crypto trading.

Key Features

- Cross margin support using shared collateral across all markets

- Multi-collateral margin with support for major crypto assets

- No need to convert assets into stablecoins before trading

- High leverage up to 100x on selected markets

- Isolated margin support coming soon

- Deep liquidity on major trading pairs

- Funding rate mechanism to align perp prices with spot markets

These features make Bullet’s perps suitable for both high-frequency traders and advanced retail users who rely on leverage and efficient capital deployment.

Also, you may read Hyperliquid vs Avantis vs Pacifica vs Aden vs AsterDEX – Check NOW!

Spot Trading

Bullet’s spot market is designed for users who want direct ownership of digital assets. When trading on spot, users buy and sell real tokens at real-time market prices, giving them full custody after settlement.

Key Features

- Support for leading cryptocurrencies and selected emerging tokens

- Secure wallet infrastructure coming soon

- Planned margin trading functionality

- Simple buy and sell execution

- On-chain settlement with non-custodial control

This makes the spot market ideal for long-term investors, portfolio builders, and traders who prefer unleveraged exposure.

Also, you may read ApeX Review: The Ultimate Guide

Lending and Borrowing

Bullet’s lending platform allows users to earn passive income on idle assets or unlock liquidity without selling their holdings. Users can supply assets to earn yield or borrow against their portfolio when needed.

Key Features

- Passive yield generation on deposited assets

- Overcollateralized loans for improved safety

- Customizable asset weightings based on risk profiles

- Variable interest rates

- Looping strategies to enhance returns

This system is suited for users who want to balance trading activity with income generation and liquidity management.

Also, you may read 5 Best Risk Management Books

Strategy Vaults

Strategy Vaults are designed for passive investors who want exposure to professional trading strategies without actively managing positions. Users deposit funds into vaults, and Bullet’s infrastructure handles execution, risk controls, and rebalancing automatically.

Key Features

- Fully automated portfolio and trade management

- No manual trading required

- Real-time performance tracking

- Access to multiple strategy types

- Options ranging from conservative to high-risk

- Flexible withdrawals based on vault rules

Vaults are ideal for users who prefer a hands-off approach while still benefiting from advanced market strategies.

Also, you may read ApeX Review: The Ultimate Guide

Bullet Review: Tokenomics

The BULLET token is the native network token that powers the Bullet ecosystem and keeps its trading infrastructure operational. It plays a central role in network security, transaction processing, governance, and user incentives. Rather than being a purely speculative asset, BULLET is designed as a functional utility token that supports both the technical and economic stability of the platform.

Also, you may read 10 Top Charting Tools for Traders

Token Supply and Allocation

The BULLET token supply is distributed across multiple categories to balance community ownership, ecosystem growth, and long-term development.

| Category | Allocation | Details |

|---|---|---|

| ZEX Liquid Migration | ~20% | 1:1 conversion of ZEX circulating supply at TGE. Community-owned allocation |

| Strategic Treasury | 42.2% | Used for ecosystem growth, grants, partnerships, and incentives |

| Private Sales | 17.8% | Linear vesting over 2 years from TGE |

| Team | 20% | Linear vesting over 3 years from TGE |

Bullet Review: ZEX Token Migration

The Zeta Markets Protocol, a DEX on Solana has been discontinued. Bullet is a network purpose-built for trading featuring a trading primitives built into the core protocol. In order to become a fully fledged network the BULLET token will be introduced and used for more fundamental chain operations such as gas fees on the Bullet network and for nodes which operate and secure the network.

The existing circulating supply of ZEX will be migrated to Bullet with 1:1 rights into the BULLET token. The BULLET token will be generated after Bullet mainnet release once the network is stable.

Also, you may read Top 10 best Crypto Telegram Pump and Dump Group

Bullet Review: Campaigns

Trading Cups on Bullet

Bullet organizes competitive trading events known as Trading Cups to test its infrastructure, engage the community, and showcase its high-performance trading environment. These competitions are designed to simulate real market conditions, allowing traders to experience Bullet’s institutional-grade perpetual trading system while competing for rewards.

As Solana’s first network extension built specifically for trading, Bullet uses these events to stress-test its execution layer, gather user feedback, and refine platform performance ahead of wider adoption. Trading Cups also serve as an onboarding channel for new users who want to explore the platform in a competitive yet controlled environment.

Also, you may read Best Smart Contract Wallets (DeFi Wallets)

Bullet Breakpoint Cup Overview

The Bullet Breakpoint Cup was launched to commemorate the release of Bullet’s gated mainnet. It functioned as both a community engagement initiative and a large-scale performance test of the network under active trading conditions.

The competition was incentivized with a $5,000 USDC prize pool, distributed as trading credits directly into users’ Bullet accounts. While these credits could not be withdrawn, traders were allowed to withdraw any realized profits generated through trading.

Participants were ranked based on their dollar-denominated profit and loss (PnL), ensuring that rewards were distributed purely on trading performance rather than volume or risk-taking alone.

Also, you may read Ostrich Review: A Comprehensive Guide

| Category | Details |

|---|---|

| Event Name | Bullet Breakpoint Cup |

| Purpose | Gated mainnet launch celebration and network stress testing |

| Platform | Bullet (Solana Network Extension) |

| Prize Pool | $5,000 USDC (as trading credits) |

| Reward Type | Non-withdrawable trading credits |

| Profit Withdrawal | Allowed on realized profits |

| Start Date | 11 December 2025 |

| End Date | 18 December 2025 |

| Trading Instruments | Perpetual Futures |

| Ranking Method | Dollar-denominated Profit & Loss (PnL) |

| Winning Criteria | Highest net trading profit |

| Distribution Method | Credited directly to Bullet trading accounts |

Conclusion

Bullet positions itself as one of the most ambitious trading platforms in the Solana ecosystem by combining institutional-grade infrastructure with decentralized transparency. Its network extension model, ultra-low latency execution, and integrated ecosystem of perpetual futures, spot trading, lending, and strategy vaults make it a comprehensive solution for both active traders and long-term investors. By addressing core DeFi challenges such as congestion, unpredictable fees, slow settlement, and poor user experience, Bullet creates an environment that closely mirrors the efficiency of centralized exchanges without compromising self-custody.

Frequently Asked Questions

Can beginners use Bullet?

Yes. With embedded wallets, gasless transactions, and simplified onboarding, Bullet is designed to be accessible even for users who are new to DeFi.

Is my money safe on Bullet?

Bullet is non-custodial and uses cryptographic verification through zkVMs. Users retain control of their funds, and all transactions are verifiable on-chain.

Are there any trading competitions on Bullet?

Yes. Bullet organizes Trading Cups such as the Breakpoint Cup, where traders compete based on profit and earn rewards in trading credits.